Plan Your Financial Future with Expert Guidance

In today's complex financial landscape, Path2Wealth is here to help you navigate the uncertainties and design a customized plan that aligns with your unique financial goals and aspirations.

Ethical and Fiduciary Responsibility

As fiduciaries, we are committed to upholding the highest ethical standards. Your financial interests are our top priority, and we are dedicated to offering unbiased advice that serves solely your best interests. You can rely on us to act with integrity and professionalism in every decision we make.

Why Is It Important To Plan?

When it comes to your personal or business finances, knowing your cash flow, if you are on track to your future lifestyle needs, what investment options you have, and if tragedy strikes will your family be ok, are what most clients are asking.

If you can relate to any of these items, you are not alone.

Comprehensive Financial Planning:

Building a secure and prosperous future begins with comprehensive financial planning. At Path2Wealth, we take a holistic approach to managing your finances, ensuring that every aspect of your financial life is strategically aligned with your long-term goals. Our expert guidance helps you navigate the complexities of financial planning, giving you the confidence and clarity to achieve lasting financial security.

Investment Management:

Investment management is a strategic process that focuses on building and overseeing a portfolio tailored to your financial goals, risk tolerance, and time horizon. At Path2Wealth, we leverage expert insights and in-depth market analysis to help you optimize returns while managing risk. Our goal is to ensure your assets grow steadily over time, providing you with a solid foundation for financial success.

Retirement Planning:

Retirement planning is a proactive approach to securing a comfortable and financially stable future. At Path2Wealth, we help you assess your current financial situation, set clear retirement goals, and develop a tailored strategy to accumulate the assets you need for the lifestyle you envision. Our expertise ensures that you’re well-prepared to enjoy your retirement years with peace of mind.

Estate Planning and Wealth Transfer:

Estate planning and wealth transfer are crucial for managing your legacy and ensuring that your assets are distributed according to your wishes. At Path2Wealth, we guide you through creating a comprehensive estate plan that addresses how your assets will be handled, including the preparation of wills, trusts, and power of attorney arrangements. Our expertise ensures that your wealth is transferred smoothly and according to your intentions, providing peace of mind for you and your loved ones.

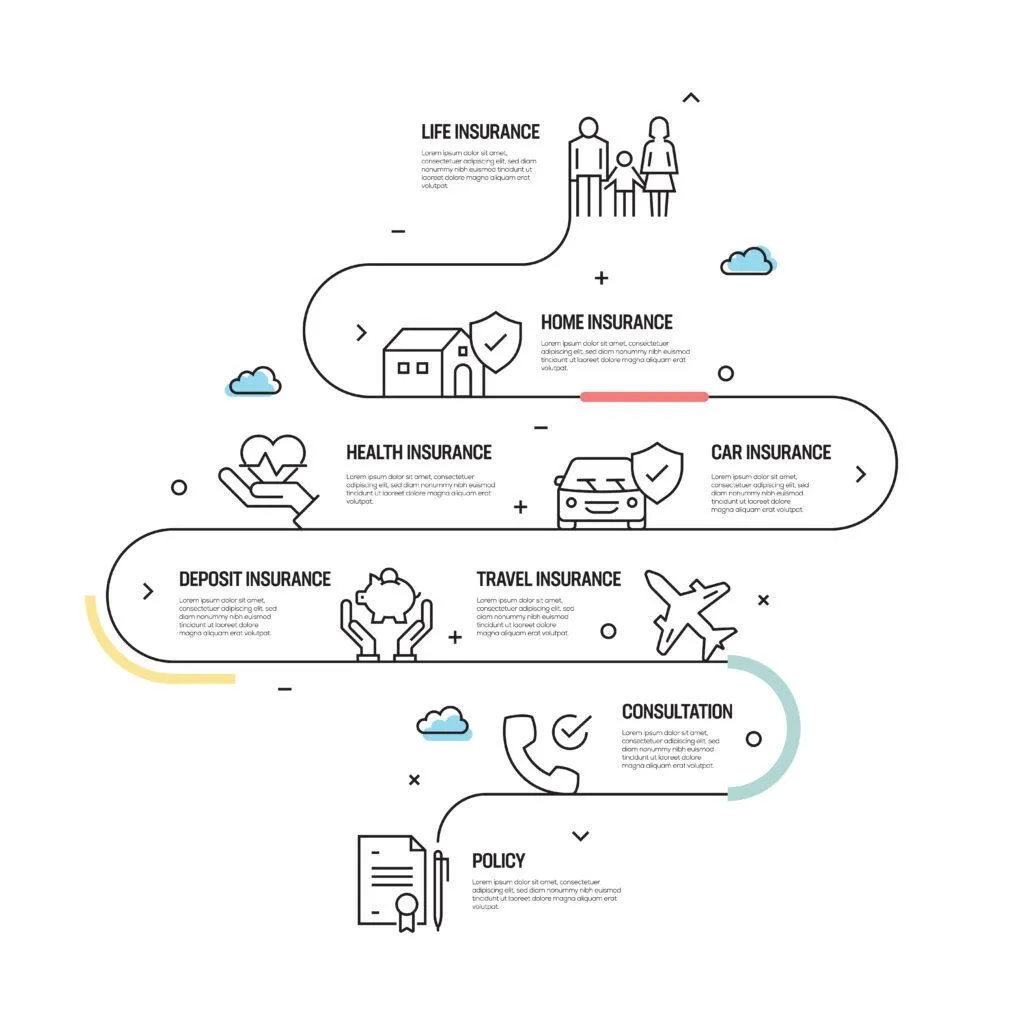

Insurance Programs:

Path2Wealth helps clients navigate their insurance needs by offering personalized solutions that protect their financial future. Whether it's life insurance, home insurance, or health insurance, Path2Wealth ensures our clients receive the right coverage tailored to their unique situations. With expert guidance, Path2Wealth simplifies the complexities of insurance, making it easier for clients to make informed decisions that safeguard their families, assets, and businesses.

Meet The Path2Wealth Team

John Aarssen

Stacey Aarssen

Todd Gillick

Here Are Some Commonly Asked Questions

What is the benefit of working with a financial advisor?

Working with a financial advisor offers numerous benefits. First and foremost, advisors provide expertise and guidance tailored to your unique financial situation and goals. They can help you create a comprehensive financial plan, optimize your investments, minimize taxes, and ensure you're on track to achieve your financial objectives. Additionally, advisors offer peace of mind, knowing that you have a professional managing your financial affairs and helping you make informed decisions.

How do I choose the right financial advisor for my needs?

Choosing the right financial advisor is a critical decision. Start by assessing your own financial goals and preferences. Look for advisors with the appropriate qualifications and certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Consider their experience, specialization, and track record. It's also important to have a consultation or interview to ensure their approach aligns with your values and objectives. Lastly, check for transparency in fees and compensation to avoid surprises.

Do I need a large portfolio to benefit from financial advisor services?

No, you don't need a large portfolio to benefit from financial advisor services. Financial advisors can assist individuals at various stages of their financial journey, from those just starting to save to those with substantial assets. Advisors can help you create a financial plan, manage debt, set up an emergency fund, and make the most of your resources, regardless of your current wealth. Their goal is to help you improve your financial well-being and work towards your financial goals, whatever they may be.

Why Choose Path2Wealth?

Choosing Path2Wealth to manage your investments means entrusting your financial future to a team of experts dedicated to helping you achieve your goals. We understand that every investor's situation is unique, which is why we take the time to get to know you, your risk tolerance, and your long-term objectives. With our personalized approach, we craft a tailored investment strategy that aligns with your specific needs, ensuring your portfolio is optimized for growth while carefully managing risk.

At Path2Wealth, we stay ahead of market trends and leverage cutting-edge tools and research to make informed decisions on your behalf. Our commitment to transparency and communication means you’re always in the loop, with regular updates and insights into how your investments are performing. At Path2Wealth, you gain a trusted partner who is as invested in your financial success as you are, providing you with the confidence to pursue your financial goals with peace of mind.